In the past, people buying property had to depend on agents and lots of paperwork, and plan visits to make their decisions. Because of the customers’ slow decision-making, buyers started getting frustrated, and the old way of breaking deals began to crumble. As paperwork and deals were thrown aside, mobile technology to discover, compare, and make decisions was rapidly adopted. The real estate app development was quickly adopted.

As real estate technology apps become integrated into buying and selling property, the question arises: How much does it actually cost to build a real estate app in 2026?

For the past couple of years, the costs of developing real estate apps have started a downward trend. Additionally, 30% of the cost is dependent on the developer’s experience, and the remaining 70% is based on the app features determined before construction, so the cost of real estate app development typically ranges from $10,000 to $100,000+. For instance, reliance on virtual property tours during initial searches, AI property recommendations, and property search along a customer-defined pathway are a few additional ways to determine costs.

Utilizing documents from previous years, the estimates for growth in the PropTech market are an 11.6% growth, year over year. The addition of user-refined property searches and virtual property tours is the primary driver. Before examining the spending estimates, an understanding of the hidden costs, growth potentials, and cost-cutting strategies is essential.

Are Real Estate Apps a Good Investment in 2026?

By 2026, real estate mobile app platforms will be contributing innovations to one of the world’s most utilized digital solutions. As the property search process moves away from traditional broker-mediated searches, businesses are investing in smarter user-centric real estate solutions driven by the latest in AI and automation.

According to Dataintelo, leading real estate platforms, such as real estate apps like Dubai REST, Zillow, and Realtor.com, are attracting millions of users, which shows the real estate industry’s digital transformation is here to stay.

Some of the reasons real estate platforms are getting more attention are:

- Mobile search driving digital property discovery: More than 80% of potential homebuyers mention mobile apps and online platforms as their property search tools of choice, directing property discovery flows towards digital.

- Broad Internet and mobile access: As per the RESimpli report, 97% of property buyers turn to the Internet to find homes, while 50% of homebuyers involve mobile devices in their search.

- AI adoption in the industry: The growing use of AI is about 75% to 80% of real estate brokerages, and agents incorporate AI tools in their activities, whether it be automated chatbots, analytical tools, or other forms of AI, which makes engagement and efficiency better.

- Role of Generative AI: From USD 2.9 billion in 2024 to USD 41.5 billion by 2033, the AI real estate market, which supports smart recommendations and virtual tours and personalizes searches, is projected to have one of the highest growth rates of any sector at the end of the decade.

Average Cost to Develop a Real Estate App in 2026?

One of the most frequently asked questions online today is: How much does it cost to build a real estate app in 2026?

The cost of a real estate app in 2026 typically ranges from $10,000 to $100,000+, depending on the features you choose, the app’s complexity, the tech stack, and the latest tech trends in real estate apps.

So, what drives these numbers up or down?

Several factors influence the real estate app development price, including design quality, backend architecture, advanced third-party integrations, real-time property data handling, and the overall expertise of the development team. Each element directly impacts performance, scalability, and long-term maintenance costs.

Now, let’s dissect the estimated cost of developing a real estate app by stages:

Real Estate App Development Cost Breakdown (Stage-wise)

|

Development Stage |

Description |

Estimated Cost (USD) |

| Planning & Research | Market research, competitor analysis, user journeys, investment goals | $1,000 – $3,000 |

| UI/UX Design | Wireframing, prototyping, interactive real estate layouts | $2,500 – $5,000 |

| Frontend Development | Building user-facing screens for Android/iOS/Hybrid | $2,000 – $6,000 |

| Backend Development | Databases, servers, property listing engines, APIs, geolocation | $3,000 – $8,000 |

| Core Real Estate Features | Listings, map views, filters, photos, videos, user accounts | $2,000 – $7,000 |

| Advanced Integrations | AI recommendations, AR/VR tours, CRM sync, valuation tools, and blockchain in real estate. | $2,000 – $7,000 |

| Payment Gateway Integration | Subscription models, featured listings, secure payments | $2,000 – $5,000 |

| Testing & QA | Functionality, performance, UX, and mobile app security | $2,000 – $6,000 |

| Deployment | Play Store + App Store publishing, compliance, setup | $500 – $2,000 |

| Post-Launch Support & Maintenance | Bug fixes, updates, mobile app maintenance, and server costs | 10-15% of your total development cost |

How much does it cost to develop a real estate app in 2026?

This is often the first question investors ask when considering the development of a real estate app for agents, tenants, or buyers. The honest answer depends on the real estate mobile app features you want, the platforms you plan to target, and the complexity of your property ecosystem.

Let’s break it down:

Basic App Development (Starter-Level Apps)

The cost to build a basic real estate app with basic features can range from $10,000 to $25,000.

This includes essential features like:

- Property listings

- Search filters

- Basic map integration

- User accounts

- Simple dashboard

A basic real estate app model and price point are ideal for startups looking to test the market without overspending. This approach keeps the property app development cost estimate manageable while offering a realistic cost to build a property listing app that supports rapid launch.

By starting lean, businesses can collect user feedback, validate the concept, and scale strategically over time. It’s a smart entry point into property technology before committing to advanced tools and enterprise-grade features.

Mid-Level App Development (Growing Real Estate Businesses)

The cost to develop a real estate app in 2026 with mid-level features ranges from $25,000 to $50,000.

These apps usually include:

- Advanced search filters

- Interactive map views

- Mortgage/EMI calculators

- Chat with agents

- Photo/video galleries

- Multi-language options

This type of real estate app is well-suited for organizations aiming to deliver an enhanced customer experience, improved property discovery, and personalized recommendations. A mid-feature real estate mobile app offers the right balance of functionality and scalability, making the cost to build a property management app worthwhile for real estate agencies focused on increasing user engagement, lead quality, and conversions.

Advanced, Feature-Rich Real Estate Apps (Enterprise Level)

When you are looking for a premium real estate app like Property Finder, Zillow, or Realtor, you need to add advanced features. The cost to develop an advanced real estate app can range from $50,000 to $100,000+.

This tier includes:

- AI-powered property recommendations

- Virtual/AR property tours

- CRM integrations

- Real-time valuations

- Multi-role dashboards

- Advanced analytics

- Cloud scalability

- Premium-level mobile app security

This type of real estate app is ideal for businesses exploring powerful real estate app ideas to dominate the market with advanced features, immersive experiences, and strong revenue models like subscriptions, featured listings, and advertising.

Cost Summary Table (By App Complexity)

| Development Stage | Estimated Cost Range |

|---|---|

| Basic Real Estate App | $10,000 – $25,000 |

| Medium Complexity App | $25,000 – $50,000 |

| High-End Feature-Rich App | $50,000 – $100,000+ |

Knowing the real estate app development cost for 2026 helps you invest wisely and focus on the features that really count, whether you are building a simple listing tool or a full-scale real estate marketplace.

Your cost to develop a real estate app will ultimately depend on your business goals, features, platforms, and your tech partner’s expertise.

Case Study: How Inventco Built an AI-Enabled App for Brokerland Real Estate

Inventco collaborated with Brokerland Real Estate to create an AI-enabled real estate mobile app designed to simplify the process of finding brokers and closing real estate deals. The app uses intelligent technology to match users with local brokers who have the most experience and who can be most helpful based on the user’s location, preferences, and intended purpose of the property. This approach fosters stronger and more rapid decision-making relationships.

Through a single platform, users can browse property listings that have been checked for accuracy, book appointments to see properties, and chat with brokers. The users can evaluate listings using confidence due to the virtual tours of the properties and real-time updates. The platform further streamlines the process by consolidating transaction management and allows users to monitor deals, view and upload documents, and set reminders to receive notifications about the transaction.

Depending on the Brokerland Real Estate app, the development costs ranged from $45,000 to $80,000. We included AI-based matching algorithms, the ability to manage multiple user roles, virtual tours, real-time chat, and a secure, scalable, and flexible backend designed for growth.

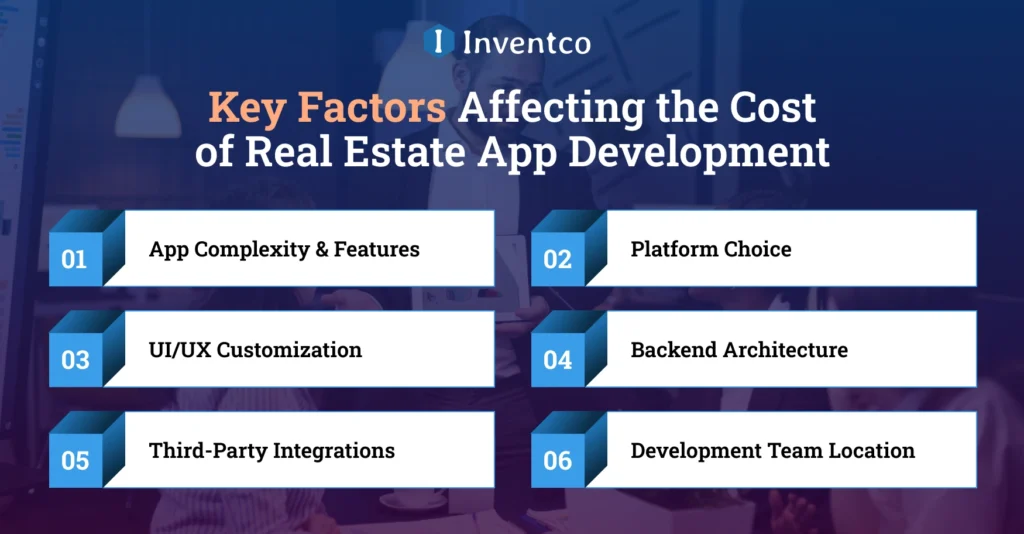

Key Factors Affecting the Cost of Real Estate App Development

Several factors influence the cost of real estate app development. Below are some key factors that affect your mobile app development cost:

1. App Complexity & Features

Simple apps require fewer screens and more straightforward logic. However, advanced real estate apps require AI, AR/VR tours, automation, analytics, and real-time data syncing, which add to development hours, resources, and overall real estate app development costs.

2. Platform Choice

When you build a real estate app for both iOS and Android, the cost increases. However, with cross-platform frameworks, you can reduce expenses and reduce time-to-market by delivering a consistent user experience across all screens.

3. UI/UX Customization

Modern, eye-catching UI/UX design increases user engagement and conversions. Still, it does need all the detailed wireframing, prototyping, animations, and customization that can take time and effort in mobile app design, as well as effectively becoming part of the real estate app development cost for businesses investing into quality.

4. Backend Architecture

Real estate apps require a robust backend system with a secure database, cloud services, fast APIs, advanced search filters, and maximum performance. Complex backend logic significantly increases the development workload and the overall cost of real estate app development.

5. Third-Party Integrations

Integrating third-party APIs such as Google Maps, MLS data, mortgage calculators, CRM tools, secure payment gateways, notifications, and OTP services enhances your mobile app development. Still, it also increases the cost to build a real estate mobile app, as they come with subscription fees and integration time.

6. Development Team Location

The cost to hire a mobile app developer varies globally. The app developers in the US can charge around $25–$50/hr, Eastern European app developers can cost around $25–$40/hr, whereas hiring dedicated mobile app developers from Asia can cost around $15–$30/hr. The development team’s location also influences the cost to develop a real estate app.

These factors, combined, determine the cost of developing a Real Estate app in 2026.

Hidden Costs in Real Estate App Development

Most businesses would calculate only the time of development and neglect long-term remuneration. Here are the key factors that silently increase the property app development cost estimate:

1. Mobile App Testing

Mobile app testing is one of the most critical factors that can increase the mobile app development cost. It is essential to ensure performance, usability, bug fixes, security, and device compatibility to ensure the smooth functionality of your real estate mobile app. The final QA cycles directly affect the overall cost of creating a real estate app.

2. App Deployment Charges

Publishing your real estate app requires Google Play and Apple App Store developer accounts, each with deployment fees that add to your total project expenses during the launch phase.

3. Mobile App Maintenance & Updates

One of the most hidden costs in real estate app development is mobile app maintenance and updates. Regular mobile app updates, bug fixes, new OS compatibility, security patches, and feature enhancements are necessary to deliver a real estate app that can increase the annual mobile app maintenance cost.

4. Third-Party API Subscriptions

APIs for maps, POS systems, cloud hosting, messaging, and geolocation services incur ongoing subscription costs that add to long-term real estate app development and operating expenses.

5. Security & Compliance

Real estate apps handle highly sensitive information, and features such as encryption, secure authentication, compliance checks, and adherence to regulatory standards raise the cost of full-stack real estate app development to ensure safety and trust.

These costs essentially influence the cost of developing a real estate app in the year 2026, so businesses should plan for long-term sustainability.

How to Minimize Real Estate App Development Cost Without Sacrificing Quality?

If you want to save money while developing a real estate mobile app without compromising quality? Here are some key points that you can use to minimize the real estate app development cost:

- You can build an MVP mobile app at the start, and after that, you can add features to reduce the cost of app development.

- Opt for cross-platform app development to reduce development time by 40%.

- Avoid useless features in the MVP app or your first version of a real estate app.

- Choose an experienced yet cost-efficient real estate app development company.

- Plan a precise and technical roadmap for your mobile app development to avoid revisions.

- You can use mobile app wireframing to reduce development errors.

These strategies for building a real estate mobile app can help you reduce costs while maintaining performance and user trust.

Why Choose Inventco for Your Real Estate App Project?

As a leading mobile app development company, we deliver high-performing, scalable, and feature-rich real estate mobile apps tailored to your business model.

Our team of expert mobile app developers specializes in modern tech stacks, AI automation, AR/VR integration, and secure architectures.

Whether you are looking to build a property listing app or a complete real estate ecosystem, we ensure predictable pricing, a high-quality mobile app, and transparent communication.

Conclusion

The cost to develop a real estate app in 2026 ranges from $10,000 to $100,000+. Still, the final price depends on several factors, including the mobile tech stack, app complexity, design, features, and scalability.

But with the proper planning, the right mobile app development team, and future-ready features, you can turn your real estate mobile app into a powerful revenue engine. Ready to build yours? Let’s make it happen.

FAQ’s

Q1. How much does it cost to develop a real estate app in 2026?

Ans. The cost to develop a real estate app in 2026 ranges from $10,000 to $100,000+, depending on app size, complexity, platform choices, features, integrations, and development team location. Advanced AI or AR features significantly raise costs.

Q2. What affects real estate app development cost the most?

Ans. Significant factors include app complexity, UI/UX design depth, backend architecture strength, feature list, integration needs, developer location, testing, scalability, third-party APIs, and security requirements. Each of these elements directly impacts the final real estate app development cost.

Q3. How long does it take to build a real estate app?

Ans. Building a real estate app usually takes 3 to 12 months, depending on features, platform selection, complexity, number of screens, testing cycles, design customization, backend setup, and integration needs. Larger, more advanced apps naturally require longer timelines to complete.

Q4. Are real estate apps profitable?

Ans. Yes, real estate apps can be highly profitable through premium listings, subscription plans, advertisements, commissions, lead generation, and featured placements. Strong user engagement, advanced features, and effective scaling help businesses achieve higher ROI and long-term digital revenue growth.

Q5. Do I need maintenance after launch?

Ans. Yes, ongoing maintenance is essential for stability, performance, and security. It includes regular updates, bug fixes, OS compatibility adjustments, API upgrades, security patches, and feature improvements. Proper maintenance ensures your real estate app stays reliable, competitive, and user-friendly.