In 2026, e-wallet app development isn’t just about enabling digital payments, it’s about building a platform that users trust, businesses scale with, and regulators can confidently endorse. As cashless transactions become the norm, both startups and enterprises are racing to launch feature-rich digital wallet apps that do more than move money, they reshape the financial experience.

There will be over 5.3 billion digital wallets by 2026. This means that over 50% of the global population will choose to store their money digitally rather than in physical currency. With expected growth in digital wallets, developers are enhancing their wallets to deliver the best services to their customers.

In the digital wallets industry, integration of eWallets into business customers digital wallets has become a necessity. Understanding digital wallets as a business has never been as important as it is today.

In this blog, we highlight the primary e-wallet features customers expect by 2026 and the value-added features businesses need to remain competitive.

Market Trends and Future Projections for EWallet Usage

The eWallet app market has shown tremendous growth, driven by increasing digital payment adoption, mobile usage, and borderless trade, and is expected to continue transforming the consumer-business relationship in 2026.

- According to Bank of America, the number of digital wallet users is projected to exceed 5.3 billion globally by 2026, representing over half of the world’s population.

- Mobile wallet market value is expected to grow from $266.85 billion in 2025 to an estimated $317.12 billion in 2026.

- Digital wallets accounted for over 50% of global e-commerce transaction value, reflecting widespread adoption.

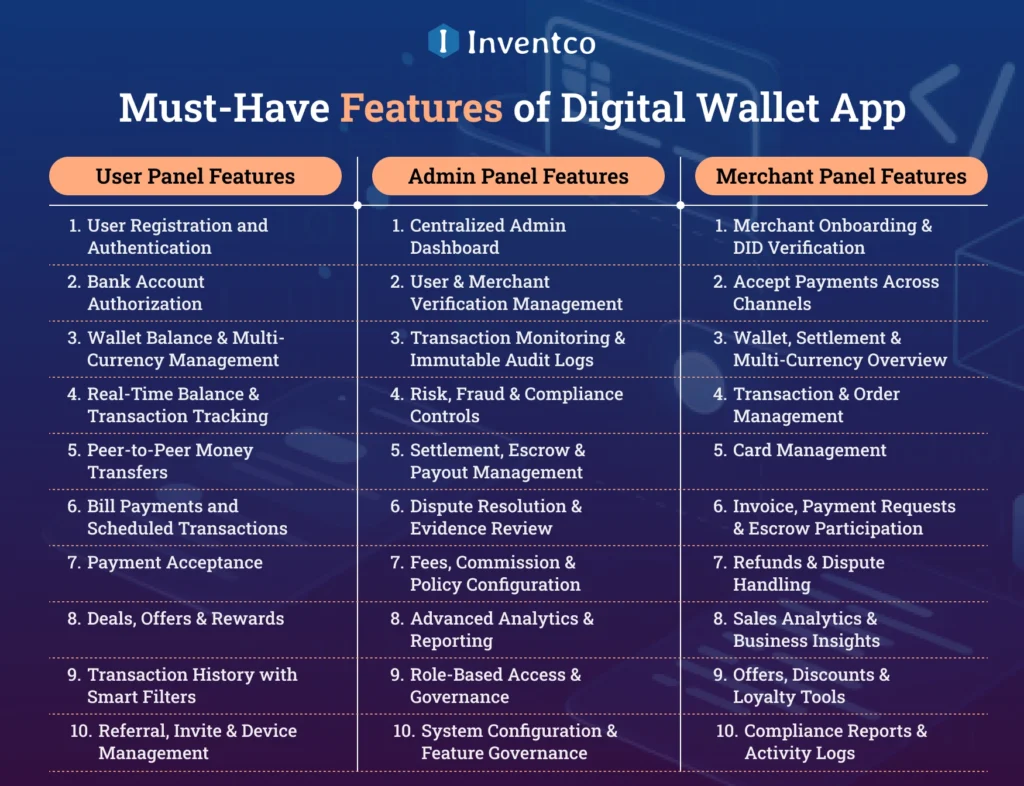

Must-Have Features of Digital Wallet App

In 2026, eWallet app development focuses on four feature categories: user, admin, merchant, and advanced features, ensuring seamless transactions, compliance, scalability, and enterprise-grade security for modern digital wallet applications.

User Panel Features

The building blocks of successful eWallet applications include user panels. These components will require users to have secure access to their accounts, seamless transactions, and real-time visibility into their finances. Users will be able to manage their digital wallets with full control over payments, transfers, and balances.

1. User Registration and Authentication

Users can register via email or social media. They will also be protected by multi-factor and biometric authentication, as well as device-level security controls. This registration method eliminates over many barriers, provides identity theft and account protection, strengthens overall account security, all while keeping a seamless user experience. This keeps the onboarding process compliant to regulations while optimizing the global eWallet user experience.

2. Bank Account Authorization

Users can now link and grant permission to their bank accounts via secure, encrypted connections. This enables the app to check and track transactions while remaining within legal boundaries. This also reduces the risk of fraud for users and enables seamless transfers to and from wallets and bank accounts globally.

3. Wallet Balance & Multi-Currency Management

Users can add funds to their digital wallet, check their balances, and switch between currencies within the same eWallet. This means payments, conversions, and financial control are instant and not restricted to a single country.

4. Real-Time Balance & Transaction Tracking

Users receive notifications about their available balance, transaction statuses, and transaction history over time. This level of transparency enables users to make more mindful spending decisions, detect issues more quickly, build trust through greater visibility, and track their financial activities across wallets, payments, and recurring transactions globally.

5. Peer-to-Peer Money Transfers

Users can send and receive funds instantly and securely to and from other users via their verified wallets and accounts. This service enables fast, reliable, cashless transactions between users, supports daily cashless transactions, and enables real-time cross-border digital payments.

6. Bill Payments and Scheduled Transactions

Users can pay bills and manage services, including utilities and other recurring subscriptions. This ability helps balance the user’s available funds and instills discipline in their financial activities by preventing missed payments for utilities and other recurring services through service reminders. This service is offered across platforms internationally.

7. Payment Acceptance

Users can receive payments easily and securely by providing their wallet-linked account information or scanning a QR code. This service, along with freelancing and other business transactions, promotes faster payments and reduces friction in portfolio and cash collections.

8. Deals, Offers & Rewards

Users can access, track, and redeem promotional offers, cashback, and rewards while processing transactions. This feature increases user engagement and encourages more transactions, delivering value across multiple transactions and improving the experience across industries, platforms, and markets.

9. Transaction History with Smart Filters

Every transaction is logged and organized by date, currency, type, and status, enabling users to quickly search, review, track finances, and manage disputes for greater transparency and financial management across periods, platforms, and devices.

10. Referral, Invite & Device Management

Users can send invites to their contacts, manage active sessions, and remotely log out from other devices. This feature strengthens account security, prevents unauthorized access, promotes user growth via referrals, and enhances control for users wallet features across different devices.

Admin Panel Features

The eWallet Admin Panel is an all-in-one management dashboard that enables platform owners to manage users, record activities, and track transactions, while ensuring regulatory compliance and mitigating risks across the digital payments ecosystem.

1. Centralized Admin Dashboard

With the central admin panel, admins can view and monitor parameters such as users, merchants, transactions, revenue, platform KPIs, and compliance to make informed decisions and address potential issues. This streamlining of operations allows admins to maintain control of the platform’s health and regulatory compliance globally.

2. User & Merchant Verification Management

Managing user and merchant verifications end-to-end involves integrating KYC and AML processes, including onboarding reviews and approvals, as well as ongoing regulatory monitoring of all users. This approach builds trust in the ecosystem, prevents fraud, and maintains legal compliance. This can all be achieved in a seamless, safe, consistent, and transparent manner on a global scale.

3. Transaction Monitoring & Immutable Audit Logs

With a digital wallet, users, stakeholders, and regulators can be assured of transparency and accountability in long-term data management through an all-in-one activities and digital record management system. This system helps in compliance audits, dispute resolution, forensic examination, and ultimately ensures data integrity.

4. Risk, Fraud & Compliance Controls

Risk management, fraud prevention, and compliance use AI and behavioral analytics combined with rule-based controls and monitoring to detect and mitigate the risk of fraud, financial crime, and suspicious activities, reducing risk and protecting users, merchants, and the platform from the financial, operational, legal, and reputational risks and fraud globally and at scale.

5. Settlement, Escrow & Payout Management

Management of settlements, escrows, and payouts enables administrators to oversee fund release, escrow terms, delayed settlements, refunds, and failed payouts. This ensures accurate reconciliation, liquidity control, regulatory compliance, prompt payment management, and a reliable experience for all stakeholders across platforms and regions.

6. Dispute Resolution & Evidence Review

Evidence review and dispute resolution provide administrators with a centralized system for the efficient review of disputes via transaction histories, chat logs, and entered documents, ensuring equitable outcomes, the speed of resolution, compliance with regulations, reduction of chargebacks, transparency, and improved trust among ecosystem platform users, merchants, and stakeholders.

7. Fees, Commission & Policy Configuration

Configuring platform commission, fees, and policies, and the enforcement of policies relating to merchants, incentives, cash-back, and commissions give administrators the ability to implement flexible monetization strategies, and transparent pricing with compliance, optimizing revenue, and developing scalable business models with consistent and sustainable governance across all transactions, partners, regions, and markets.

8. Advanced Analytics & Reporting

Advanced analytics and reporting help measure performance and identify optimization and operational risks in the eWallet ecosystem. It also supports strategic planning and fosters data-driven operational activities. These analytics support the assessment of compliance exposure, user retention, transaction behavior, growth trends, and risk mitigation on a global scale.

9. Role-Based Access & Governance

Role-based access and governance, along with granular permission management, ensure that internal teams operate in compliance, with supported workflows for duty segregation, minimized insider threats, secure operational processes, and justified access to sensitive data across finance, compliance, support, and other administrative functions globally.

10. System Configuration & Feature Governance

Administrators are empowered by System Configuration and Feature Governance to activate, limit, or scale features according to regional, regulatory, risk-based, or platform growth criteria. This ensures compliance, operational performance, and adaptability. It also allows for the controlled evolution of the eWallet ecosystem and stable global operations.

Merchant Panel Features

The merchant panel provides businesses with features for accepting payments, managing settlements, tracking transactions, and gaining insights on performance, allowing for operational ease, increased cash flow, and growth potential within the eWallet ecosystem, while upholding compliance, security and a seamless payment experience across channels.

1. Merchant Onboarding & DID Verification

Merchants complete secure onboarding via Decentralized ID integration, which provides identity verification that is faster, fraud proof, and compliant with regulations without the need for redundant documentation and builds trust between systems, merchants, financiers, and regulators within the global digital payment ecosystem.

2. Accept Payments Across Channels

Merchants can accept payments via multiple channels such as wallets, QR codes, payment links, and cards, which provides seamless checkout, faster settlements, reduced friction, broader reach, and consistent payment acceptance across online, offline and omnichannel commerce.

3. Wallet, Settlement & Multi-Currency Overview

Merchants receive a detailed overview of wallets displaying balances, pending settlements, processed payouts, and earnings by currency. This provides visibility into cash flow, simplifies financial forecasting, and improves cross-country and cross-market management of multi-currency revenue at scale.

4. Transaction & Order Management

Merchants can manage and monitor payments, customer information, invoices, and transaction history in real-time. This means merchants can manage operational processes, minimize errors, and address discrepancies. They can also improve the accuracy of fulfillment and transparency with the payment channels worldwide and in a secure manner.

6. Card Management

Merchants can manage their physical and virtual cards integrated with the wallet, including setting payment limits, tracking spending, and blocking suspicious transactions. This improves payment security, expense control, operational flexibility, and global business transactions.

7. Invoice, Payment Requests & Escrow Participation

Merchants can participate in creating invoices, payment requests, and escrow-based transactions, including payment guarantees, milestone releases, clear agreements, and payment dispute resolution. These features support cash-flow improvement and trust-building among buyers, sellers, and platforms across the global transactional ecosystem.

8. Refunds & Dispute Handling

Merchants can manage disputes using documented support and communication logs, enabling quick resolution, regulatory compliance, and reduced chargeback requests in digital wallet merchant operations. Improved customer satisfaction, secure and consistent processing, and optimal outcomes are the results of these operational processes conducted worldwide.

9. Sales Analytics & Business Insights

Merchants receive sales analytics and insights, including revenue, customer behavior, conversion rates, and peak activity times. This fosters data-driven decision-making, performance optimization, demand forecasting, strategic planning, and sustained growth across channels, regions, and global market conditions.

10. Offers, Discounts & Loyalty Tools

Merchants can implement offers, discounts, and loyalty schemes to increase engagement, repeat purchases, and transactions. This attracts new customers, improves retention, and strengthens brand relationships to build revenue across the competitive global digital commerce ecosystem to support sustainable, secure, and enterprise scale growth and long-term retention.

11. Compliance Reports & Activity Logs

Merchants can receive and review compliance reports and activity logs for audits, taxes, and other regulatory requirements, to ensure transparency, record-keeping, and compliance reporting, legal, and financial regulation adherence across multiple regions, industries, and compliance systems worldwide in a secure, consistent, and reliable manner and enterprise scalability.

High-Impact Advanced Features in eWallet App Development

High-impact advanced features elevate eWallet app development by enhancing security, automation, scalability, and compliance. This enables eWallets to simplify complex transactions, reduce risk, support global payments, and deliver top-tier digital wallet solutions in competitive, regulation-driven markets in 2026.

1. AI-Powered Fraud Detection

AI-powered mobile apps enhance digital security using machine learning models to assess and detect real time transactional disruptions, flag and stop suspicious activities, provide screen safeguards to stop unauthorized access, mitigate potential financial losses, provide adherence to financial law, and perpetually adjust to the new fraudulent activities.

2. Biometric Authentication

Biometric scans and the software of eWallets that use fingerprint scanning, Face ID, and behavioral biometrics provide strong identity verification, mitigate credential theft unauthorized access, and improve user experience by providing seamless access authentication and security across multiple devices.

3. End-to-End Encryption & Tokenization

End-to-end encryption and tokenization provide users with a sense of transparency and security. Users feel secure knowing that their real banking information, presented as transactional real estate, is protected in blockchain and other ledgers, never exposed, and always remains within the trusted transactional network. Corporate users will always feel safe entrusting their business to their digital wallets.

4. Automated KYC, AML & DID Workflows

Automated KYC, AML, and DID workflows streamline onboarding and identity verification, enabling onboarding across centralized and decentralized systems. They also monitor transactions, flag suspicious activity, and ensure regulatory compliance. They reduce the need for manual intervention and foster trust among users, merchants, and financial ecosystems worldwide.

5. Multi-Currency & Cross-Border Payments

Multi-Currency and Cross-Border Payments capabilities enable users to transact internationally, supporting global commerce through real-time settlement and providing a seamless financial experience. Users can also store and transfer multiple currencies and exchange them at live rates, while minimizing the need for conversions and providing frictionless transactions. This enables seamless transactions and financial experiences across regions, markets, and digital economies.

6. DeFi Integration

DeFi integration allows users to engage in decentralized lending, staking, and wallet-to-protocol interactions. Users can access blockchain-based financial services directly from their eWallets, increasing the utility of their assets, improving transparency, and reducing the need for intermediaries. This also supports programmable finance use cases across a wide range of decentralized ecosystems.

7. Smart Escrow & Conditional Payments

Smart escrow and conditional payments reinforce trust and reduce disputes by automating the holding and release of funds based on predefined rules or milestones. This validates milestones, controls cash flow, aligns compliance, and ensures the secure execution of digital transactions across service-based, marketplace, and high-value transactions globally.

8. Real-Time Risk Scoring Engine

The risk scoring engine operates in real time, evaluating transactions based on behavior, device, location, and historical data patterns. It assigns risk levels, takes action to prevent risk, and minimizes exposure to fraud, and continuously secures and protects users, merchants, and platforms.

9. Blockchain-Backed Transaction Ledger

Blockchain-backed transaction ledger systems provide regulatory, trustworthy, and accurate reporting and cross-border data compliance for eWallet systems and financial partners by recording payments on distributed, immutable ledgers which provides transparency, audit and dispute traceability, and strengthens accountability and data integrity, reliable and secure at enterprise scale.

10. High-Availability & Auto-Scaling Infrastructure

HAAI ensures business continuity and optimizes performance by using cloud-native architecture, redundancy, and failover to maintain uptime during traffic spikes. This supports rapid growth and streamlining the delivery of digital wallet services across global markets and to user demands. While these high-impact capabilities define modern digital wallets, they also directly influence the eWallet app development cost in 2026. Advanced security, compliance automation, global payment support, and scalable infrastructure require thoughtful planning and investment.

Conclusion

The digital payment landscape in 2026 will require more than simply enabling transactions. eWallet applications will need to strike a fine balance between user experience and security. There are other dimensions to consider, such as, regulatory compliance, scalability, and preparedness for the evolution of digital payments. There will be a holistic user experience for end users, including fraud detection, support for multiple fiat currencies, and advanced controls for administrators. All these features will ensure that the eWallet is sustainable in the long term.

When enterprises understand feature requirements and align them with business objectives, they can better manage complexity and cost while delivering reliable financial experiences. With the right approach, the eWallet can remain flexible in response to changing regulations, user demands, and global payment trends, keeping the platform primed for continued growth in an ever-cashless digital economy.

FAQ’s

Q1. What are the must-have features in an eWallet app in 2026?

Ans. Must-have eWallet app features include secure user authentication, multi-currency wallet management, peer-to-peer transfers, admin compliance controls, merchant payment tools, and advanced security features like AI fraud detection and encryption to ensure trust, scalability, and regulatory compliance.

Q2. What is the difference between basic and advanced eWallet app features?

Ans. Basic features focus on transactions and balance management, while advanced eWallet app features include AI-powered fraud detection, automated KYC/AML workflows, smart escrow, blockchain-backed ledgers, and real-time risk scoring designed for enterprise-grade security and scalability.

Q3. Why are admin and merchant panels important in eWallet applications?

Ans. Admin and merchant panels enable platform governance, transaction monitoring, compliance enforcement, settlement management, analytics, and dispute resolution, ensuring smooth operations, risk mitigation, transparency, and monetization for businesses operating digital wallet ecosystems.

Q4. How do advanced features impact eWallet app development cost?

Ans. Advanced features significantly influence eWallet app development cost due to increased complexity, security requirements, infrastructure scaling, and regulatory compliance, but they also deliver higher trust, reduced fraud risk, better performance, and long-term return on investment.

Q5. Is multi-currency support essential for modern eWallet apps?

Ans. Yes, multi-currency support is essential in 2026, as it enables cross-border payments, global commerce, real-time currency conversion, and better user flexibility, making digital wallets suitable for international users, enterprises, and growing financial ecosystems.