We live in a digitized era. The modern era is filled with ongoing technological advancements. Innovations keep taking place all around the world. All such innovations are achieved by integrating state-of-the-art tech machinery and improved application systems.

With the rapid advancements of smartphones and other mobile devices, we are able to streamline our day-to-day activities. Whether the task is complicated or hefty, mobile applications can easily handle the operations to get you a solution on the fly.

As far as the finance sector is concerned, you can come across a myriad of leading mobile applications. These applications enable users to execute financial transactions seamlessly. Whether it is transferring a huge amount of money or obtaining money from someone, or even lending money –everything can be carried out easily online.

Businesses in the modern era wish to get access to reliable loan lending app development services due to the high customer response and demand in the existing market. There can be a moment when you might need extra money for some personal need or to start a new business. There is no option left in some cases. Or, you may want to lend some amount of money from banks or other people. Taking a loan from a bank comes with its own set of complications. Therefore, to simplify the entire process, loan lending mobile apps come to the rescue. Let us know about them in detail.

What Is A Loan Lending App?

A loan lending app serves to be a common platform between loan seekers and money lenders. On this platform, users can connect and transact/avail services. With the help of an interactive loan lending app, borrowers are no longer required to visit loan brokers, banks, or other organizations for seeking the loan amount. This is because now they can borrow money online.

Money or loan lending apps are meant for both the borrowers and lenders. The app functions like a credit card allowing borrowers to get access to instant loans. All that a user is expected to do is to install the app on the respective mobile device and register themselves on the same. They have to check the eligibility while adding personal and bank details. The loan lending applications on mobile devices save you time and effort to go to the bank, stand in queues, or talk to the banking officials.

Types Of Loan Lending Applications

You will come across a wide variety of loan lending mobile applications. They would typically differ on the basis of the different types of loans they offer to the end customers. With respect to borrowing loans, the needs of the borrowers tend to be unique from each other. This is the reason why the lending capacity of loans also tends to differ.

Some of the different types of loans that loan lending apps cater to are:

- Car loans

- Student loans

- Home or mortgage loans

- Small business or startup loans

- Personal loans

In addition to these, the apps are also famous for offering access to personal loan options to the users. It is available in the form of a service that can be availed at any time.

The loan lending apps can also be categorized on the basis of the lenders. Through the given apps, the given entities can lend loans:

- Credit unions

- Banks and other financial institutions

- Peer to peer or P2P lending

The apps are also categorized on the basis of the technology stack. Some of the core technologies on which these apps can be categorized are:

- Big Data

- Chatbots

- Machine Learning and Artificial Intelligence

- Blockchain and Smart Contracts

Read Also: Top Reasons To Have A Mobile App For Your Business

Working Of The Loan Lending Apps

As a business, do you require iOS or Android loan lending mobile apps? As a business entrepreneur, you should be aware of its working in the first place. The app works seamlessly serving all the aspects of a loan lending process catering to both lenders and borrowers. Some of the important points to understand its working are:

- A loan lending app possesses a sign-up feature for both the loan seekers and money lenders using the platform.

- The user is expected to enter personal details to ensure that their profile is verified. Therefore, they are required to enter their respective bank details. At the same time, the lenders are also required to include the bank details for making money transactions.

- Then, the borrowers can choose from the different types of loan options that are available on the loan lending mobile app. For the same, they will have to make a loan request. They also need to state proper reasons.

- When the lender finds your reason valid and reasonable, he or she will approve of the same. Otherwise, your loan request might be rejected on specific grounds. Borrowers get access to multiple options by going through different sets of benefits and interest rates. Borrowers are also given the opportunity to compare different loan schemes on the basis of factors like loan amount, interest rates, and so more.

- Both the lenders & borrowers can consider meeting up. Alternatively, they can also consider carrying out formalities of the loan application process online. This can be done by accepting specific terms & conditions of the app.

- After all the proceedings are carried, the desired amount of money will be transferred from the account of the lender to that of the borrower.

Once the users would register themselves on the app, the app would do the remaining task on itself. Here are some important steps involved in the loan lending app:

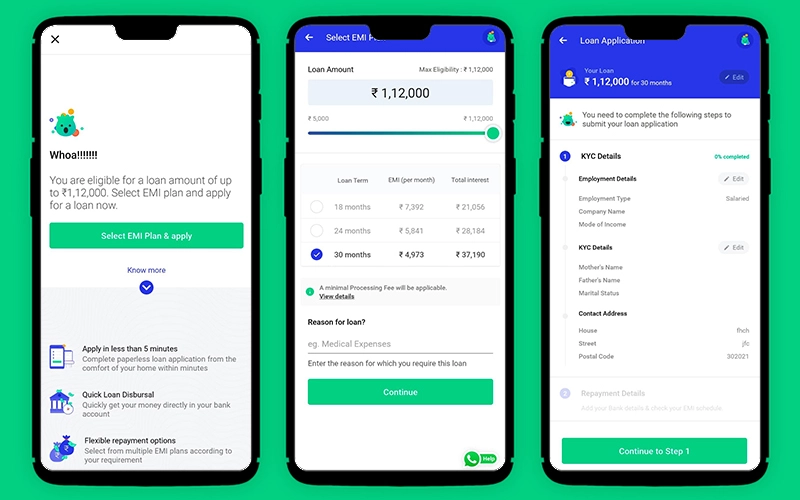

#Onboarding

Once the user installs the app on the respective mobile device, they can launch the same to enter its home page. The first step is concerned with registering oneself in the app. It can be performed by making separate accounts. Users are expected to enter specific details including name, contact number, email address, physical address, education, employment history, and so more.

Once the onboarding process is complete, the users can look into different loan options available in the app. Moreover, they can also compare different interest rates on the borrowed amount of money. Once they have compared the interest rate and the duration for which they wish to take the loan, the users can go for the selection of the particular loan type.

#Linking The Bank Accounts

A borrower is expected to link the bank account with the app to receive the intended amount of money. The bank account linking process also helps in deducting the interest amount from the borrower’s account automatically every month. This will help in avoiding issues like skipping loan payment dates or repayments. The app is also designed to send over notifications to the users with respect to loan payments and dates.

Reasons To Invest In A Loan Lending App

There is a huge demand for money lending mobile applications in the modern era. As such, financial ventures and business owners can Fintech Software Development Companies to design bespoke mobile applications. It is observed that loan lending apps are witnessing higher growths in terms of the number of downloads every year.

Some relevant stats to support the rapid growth of loan lending apps are:

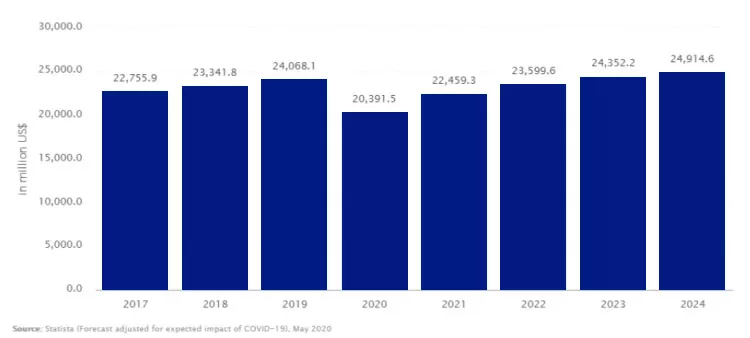

- Due to continuous growth, the market of loan lending is accelerating exponentially. As per the latest study reports, it is estimated that around 48 percent of individuals are willing to adopt modern lending apps

- It is estimated that the lending app market is expected to grow exponentially to reach around $22,459.3 million by the end of this year. By the time of 2024, the market value is estimated to reach around $24,914.6 million.

- As per another study report, it is estimated that around 31 percent of individuals have more options with these apps for ensuring the simple and quick money borrowing process.

What Are The Benefits Of A Loan Lending App?

Both money lenders and borrowers receive ample benefits from a feature-rich loan lending app. Most of the modern apps feature high-end specifications to deliver ultimate ease of use to the end users. Both lenders and borrowers are capable of doing everything possible around loan verification, authorization, acquisition, disbursement to repayment –right from the comfort of their homes.

Let us understand the benefits of a loan lending application –both from the borrower’s and lender’s point of view.

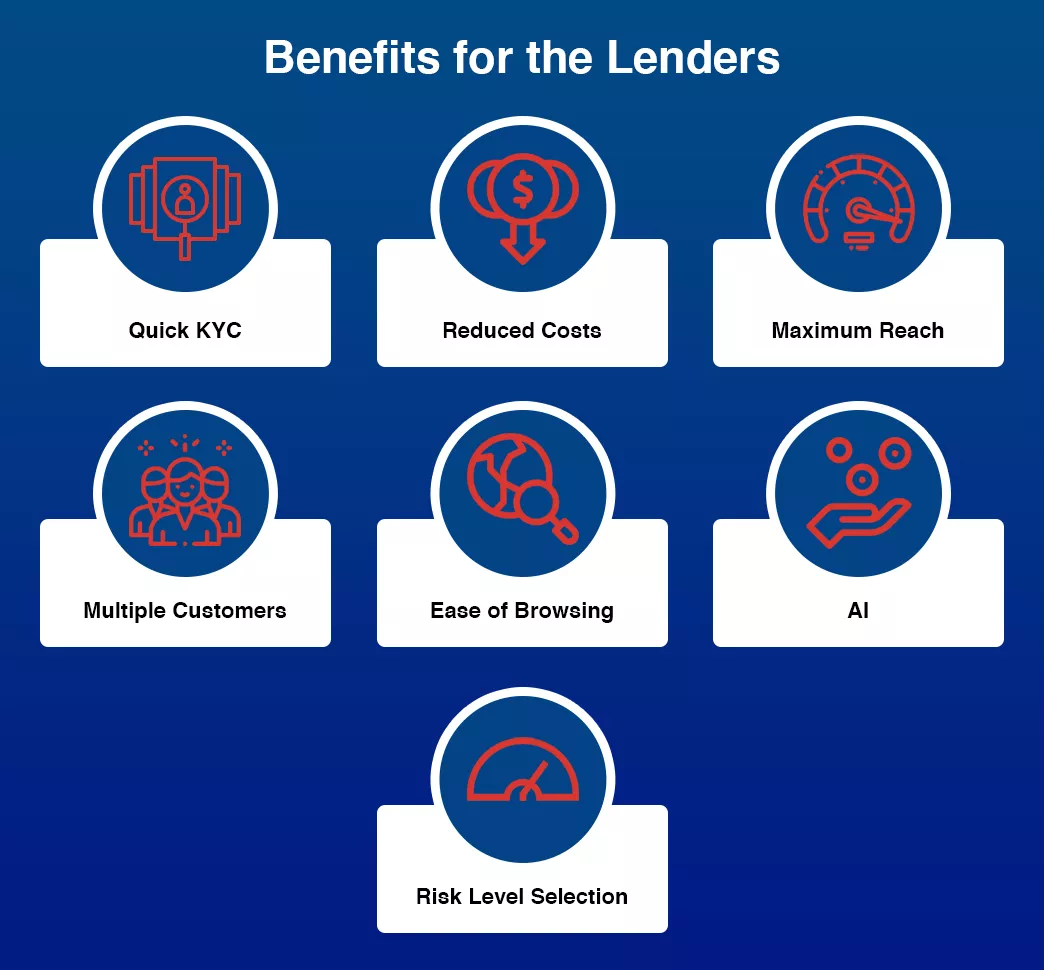

Benefits For The Lenders

#Quick KYC Processes

For the KYC process, lenders are no longer required to ask the borrowers to visit in person. The app will allow the borrowers to upload all important documents through the scan & upload feature of the app. The documents can be then downloaded at the lender’s end for the KYC process.

#Reduced Operational Costs

With the app’s operations, money lenders are no longer required to have a separate physical office space for meeting the borrowers. All the essential operations can be executed on the app itself. Therefore, this helps in minimizing the entire operational costs. Lenders can look forward to operating with minimum infrastructure –even from the comfort of their homes.

#Maximum Reach

A bank or a financial institution might not be capable of reaching out to rural areas. With a loan lending app, it is now possible to bridge the existing gap between lenders and borrowers. This is because the banking and finance app development companies allows them to connect remotely through its advanced features.

For lenders, it turns out to be a major advantage. The app allows them to get access to a number of potential borrowers out there in the market. With maximum reach, they can maximize their profits as well.

#Access To Multiple Customers

The app offers access to multiple potential customers for lenders. It will allow them to reach out to and connect with potential borrowers on the go. There is no obligation of working with a single borrower. Therefore, this helps in improving the overall profits.

#Ease Of Browsing

On the online version, lenders are capable of going through multiple applications of borrowers at a time. They can know at an instant about the number of people who have applied for the loan. With this knowledge, the use of the app becomes seamless for lenders.

#Use Of Artificial Intelligence

AI or Artificial Intelligence helps significantly in improving the loan lending process online. With AI, every transaction gets recorded and managed on the app through tech-aided processes. This helps in incredibly improving the efficiency and accuracy of the operations.

#Selection Of The Desired Level Of Risk

When lenders are using the loan lending app, they can consider selecting a particular risk level as per their convenience levels. This helps them to boost their lending profile on the portal.

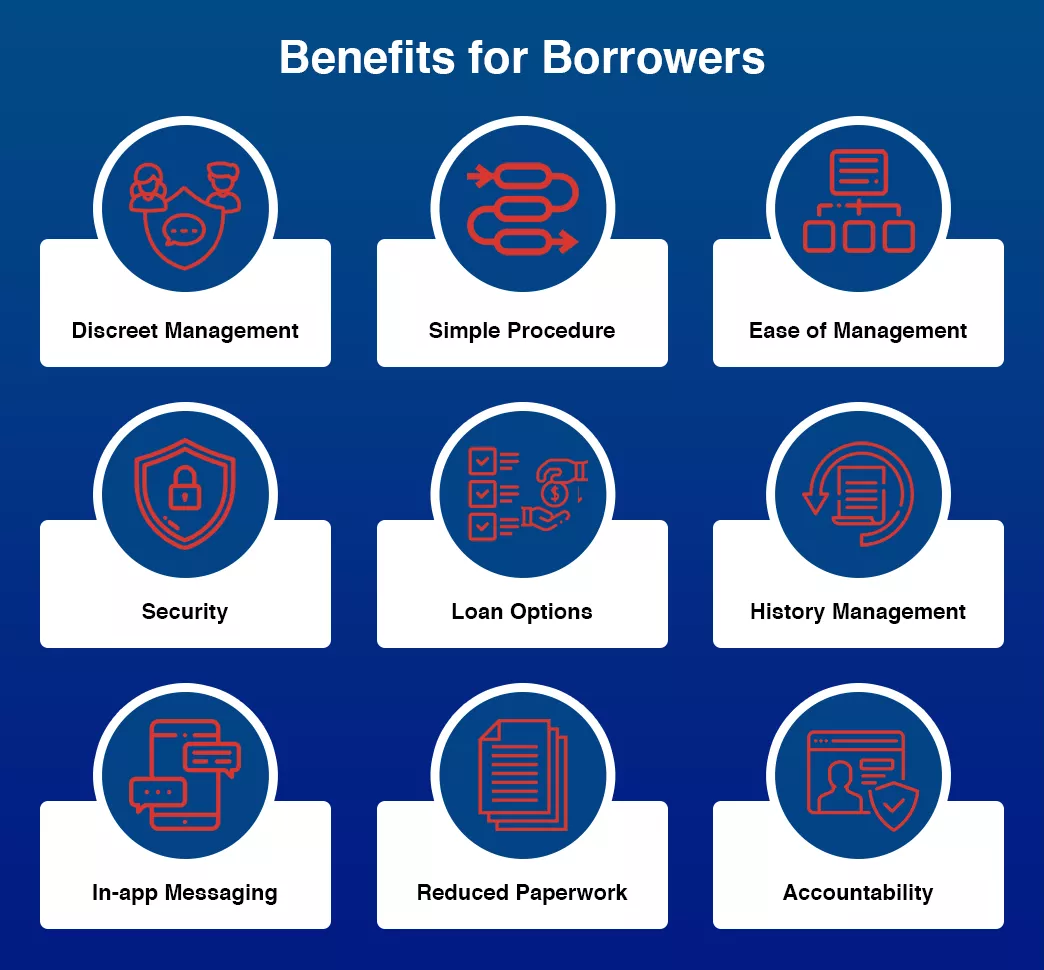

Benefits For Borrowers

#Discreet Management

The borrowers can go through the internet to search for the right loan lending app of their choice. Moreover, they can also go through the reviews and ratings of different financial apps to know about the best one out there. The entire process is quite discreet and at the sole discretion of the borrowers.

#Simplified Procedure

A loan application process might appear daunting to many. However, with a reliable loan lending app, the borrowing process becomes simple and seamless. All that the borrowers are expected to do is to fill up the online application form on the app’s interface. Along with the scanned and uploaded copies of essential documents, the users can submit their applications. Upon receiving the application, lenders can take a look at the same and give approval instantly.

#Ease Of Management

Borrowers are allowed to maintain a proper track of the application process through the app. Moreover, they can also get approval online. This saves them from making multiple trips to the banks or institutions.

#Improved Security

The transactions that are made on the loan lending platform tend to be secured. All important details are encrypted in the app. Using the platform, users can create a strong password for the respective account while assuring that they transact safely.

#Lucrative Loan Options

As all loan options can be checked and tracked online, the borrowers can go through a wide range of lucrative loan options available for which they are eligible. The borrowers can also compare different types of loan options for selecting the best one for them.

#Management Of History

In the loan lending app, all transactions are made through its interface. Moreover, all payments are made by the borrowers by logging into the app. You can access the history or the transaction log whenever there is a requirement to do so.

#In-App Messaging

The lenders and borrowers can remain in touch with one another on the given platform. They can continue discussing loans on the given platform. It is enabled through the feature of in-app messaging in the application. Using this feature, the borrowers are given the opportunity to ensure better decisions with respect to the loan.

#Reduced Paperwork

The loan lending apps require minimal to no paperwork. This is because all documents are scanned and submitted online. The users are only expected to upload scanned copies of a minimum number of documents. These documents might be required at the time of registration. This makes the total process of loan lending easier.

#Improved Accountability

The lenders who join the app tend to be reliable and recognized by earning the trust of the borrowers. In case you are skeptical about borrowing money from any lender, you can go through the detailed reviews on the apps before making the big move.

Top Loan Lending Mobile Apps Across The World

As a borrower, when you are in the urgent requirement of an instant cash loan, there are limited options available out there. One option is to seek a personal loan from a reputed bank. It turns out to be a time-consuming process. Moreover, there are multiple document submissions and paperwork involved in the entire process.

The best option for a quick way of applying for a personal loan is to make use of a lucrative loan lending application. The internet has revolutionized the manner in which modern loan lending mechanism works. There are various types of loan apps that are available. Some to look out for are:

Read Also: How To Create An Artificial Intelligence App?

#PaySense

PaySense is a leading loan lending app featuring an online platform for coming up with a personal loan offer of around 2 Lakh INR. The loan lending capability of the app is responsible for meeting your all financial needs –right from emergency requirements to home renovation, entertainment, and much more. You can consider getting a personal loan from any location, at any time, and with minimal documentation.

Some of the key features of the money lending app to look out for are:

- Getting loan approval in as little as 2 hours

- Receiving money within the account in around 5 hours

- Getting instant loan approval of around 2 Lakh INR with the help of the website or the application

- Loans are offered even when you might have zero credit history

- Affordable EMI plan with auto-debit and reminder features

- No requirement of physical documents

- You can only upload documents online

#CASHe

CASHe is one of the most reputed loan lending applications in India. The main objective of the smartphone app is to deliver access to instant personal loans. Personal loans will be helping an individual to deal with different financial situations. It could help with a wedding, some medical emergency, higher studies, and home renovation.

CASHe allows its users to borrow money -right from 1000 INR to 4 Lakh INR for a period of 90 days to 540 days. When you meet the specific requirements of the loan application process for CASHe, you can submit all the necessary documents. This allows you to instantly access personal loans.

Some of the top features of the CASHe loan lending app are:

- At CASHe, you can be assured of faster approvals when you are applying for a personal loan. The process remains hassle-free –right from applying to availing and processing the loan.

- There is no requirement of any credit score for availing the personal loan feature of CASHe. Any individual meeting the necessary eligibility criteria can apply for the loan using this app.

- When you are applying for the loan at CASHe, you will have the requirement of minimum documentation while you are applying for the personal loan feature from the app.

- One of the most important aspects of availing services from CASHe is that the loan amount gets disbursed instantly to the account. This allows you to deal with the emergency without any additional stress.

- The users of CASHe are awarded lucrative interest rates of around 2.25 percent every month.

- CASHe comes with a flexible repayment option –from around 90 days to 540 days.

#MoneyTap

MoneyTap delivers you the personal line of credit of around 5 Lakh INR. It is achieved in a secured and paperless process through the given app on the smartphone. The approval process gets completed within some minutes of installing and registering on the given app.

MoneyTap is an app that is based on the concept of a credit line allowing you to borrow as well as pay off the loans conveniently. Using the app, the personal loan is offered in amounts of as low as 3000 INR and even as high as 5 Lakh INR. It is easy to apply for loans online using the app. The same can be used for funding multiple personal needs including a wedding, a vacation, payment of medical bills, buying a gadget, and so more.

- As MoneyTap is an app based on the online platform, the process of digital loan application offers the assurance that loan application is carried out seamlessly

- At MoneyTap, the users can get approval for a higher amount of up to 5 Lakh INR. Moreover, there is also the flexibility of either withdrawing a lower amount or withdrawing the full limit.

- As it is a credit line, the interest charges remain proportionate to the amount that is withdrawn and not the total sanctioned amount. This can help in significantly reducing the interest costs in comparison to the standard personal loan.

- In addition to the flexibility of withdrawing money, the app is also known to offer the flexibility of loan repayment with the given tenure of 2 to 36 months.

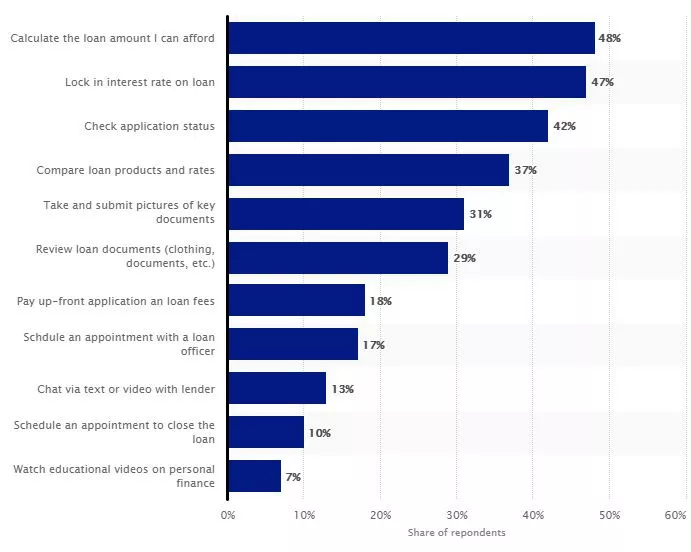

Features That Users Look For In The Loan Lending App

Some of the essential features that should be included in the loan lending app will help the users have a seamless experience throughout. Some of the important features to look out for are:

- Calculation of the amount of loan

- Lock in the interest rate on the given loan amount

- Checking application status

- Comparing loan products and the entire rates

- Taking and submitting pictures of core documents

- Reviewing loan documents

- Paying up-front applications on the loan fees

- Scheduling an appointment with the respective loan officer

- Chatting via text or video with the lender

- Scheduling an appointment for closing the loan

- Watching educational videos on the concept of personal finance

Basic Features In The Money Lending App

During the development of a loan lending app, it is important to integrate some salient features into attracting the customer base. The presence of the given feature set is going to make your app stand out amongst other apps in the market. However, it is equally important to pay attention to choosing the right features. This is because the app features remain directly proportional to the overall cost of developing the app.

Borrower Panel

- Register or Login: Users or borrowers can consider signing up for the app with the help of a contact number, email, and password.

- Bank Account Linking: Borrowers are expected to link the respective bank account details with the app profile for completing transactions seamlessly.

- Loan Form: It is the application form that the borrowers on the app are required to fill out while seeking a specific loan amount from the lenders.

- Geo-location: The app is expected to know about location-centric information of the users. It can be added manually or automatically through the GPS tracking system.

- Real-time notifications: These serve to be ways of notifying the users about the beneficial deals on different loans or the status of the loan application.

- Reminders: Once the loan approval process is complete and money has been credited into the account, the borrowers will receive notification about the amount of money to be paid regularly.

- Managing Documents: Borrowers can consider uploading important documents on the app whenever the need arises.

- Secure Payment methods: During the transaction of money, the users will receive access to ample security. They can make use of multiple payment methods like debit cards, credit cards, UPI, and internet banking.

- Chat Support: In case there is any query or doubt, users can contact the customer support team through the built-in chat mechanism.

Lender Panel

- Sign-up: Any lender wishing to join the loan lending app will be required to complete the sign-up process by entering details like name, number, email, and password.

- Profile Management: Lenders should be able to manage the respective profiles including personal information.

- Lead Management: All the requests or potential leads should be managed by the lenders.

- Payment Records: Lenders can go through the past transactions in the history tab.

- Bank Account Linking: Lenders are expected to link the respective bank accounts for receiving EMI payments from the borrowers.

- Push Notifications: The lenders should be aware of the new alerts regarding app activities.

Advanced Features To Include In The App

-

- Cloud integration

- Loan calculator

- CMS integration

- Automation repayments

- Multiple language support

Things To Consider While Developing The Loan Lending App

You need to be extra careful while developing a complex app like a loan lending application. You need assistance from a highly qualified and experienced team of loan lending app developers to deliver their knowledge and expertise to the development project.

Some core roles in the mobile app development process is:

- Financial adviser for taking care of the regulatory terms and government rules

- Banking partner for lending the given amount of loan to the users

- Legal adviser for advising you over financial matters of the app

- A reliable Public Relations company for allowing you to promote the app across multiple platforms while helping it earn reputation amongst users

- Marketing company for fulfilling goals amongst the target audience

Must-Include Key Attributes For The Loan Lending App

- Chatbot integration

- Real-time chat capability

- Real-time notifications

- Seamless payment integration

Technology Stack For Loan Lending App Development

- Front-end platforms: HTML5, Bootstrap, JavaScript, CSS, jQuery, React

- Framework: JSON, Play, Slick, Spring, Java 8+, Spring Boot, Lagom

- Database: MongoDB, PostgreSQL

- Web services: SOAP, REST

- App Platforms: React Native, iOS, Android

- Programming languages: JSON, Core Java

Team Structure Required For Loan Lending App Development

Some of the key roles needed for reliable loan lending mobile app development include:

- Requirement analyst

- Back-end developer

- Front-end developer

- UI/UX designer

- Android developer

- iOS developer

- QA Specialist

What Is The Cost Of Loan Lending App Development?

There are several factors on which the total development cost of loan lending app will depend. These are:

- Complexity of the application

- Time taken for developing the app

- Design of the app

- Features integrated into the app

- Geographical location

When you go for the country-wise stats, you can observe the costs as:

- North America -$50 to $250 per hour

- Europe -$20 to $100 per hour

- Asia – $10 to $50 per hour

- Australia -$40 to $170 per hour

Conclusion

The money lending or loan lending apps are in high demand these days. There are ample opportunities for both startups and seasoned enterprises to create a sound business model out of an automated money lending system that is served by advanced application features. In case you wish to indulge in a loan lending mobile application development project, it is important to hire the right team for its execution. Based on your specific requirements, you can hire a team that fully satisfies all your specifications on the go.